Introduction:

Riba, the Arabic word literally means ‘increase’. When the Qur’anic revelations that dealt with the prohibition of certain financial practices was revealed, the word used was riba. However, riba does not deal with financial transactions alone; it also covers other forms of ills in matters concerning various aspects of life. Here, the emphasis is on theincrease that deals with interest, especially related to banking. As per the Qur’an and Ahadith, any increase over the principal amount in a loan transaction where a waiting period also is involved comes under the ambit of riba. Thus it can be deemed as binding upon bank interest also.

Till the organized banking practices appeared on the economic scene, the question of defining riba was a non-issue, at least in the life of common Muslims. The industrial revolution that swept the world and banking that followed, affected the way the businesses were conducted. Capital gained prominence over other factors and the need to mobilize large volumes of money was a daunting task without the help from lending institutions. Entry of banking institutions eased the capitalizing pressures and everyone was happy, both the lender and the borrower. In such a scenario branding the interest charged by banks as riba became an issue. However, in most cases it did not deterMuslim business community from indulging in it.

Since riba is not solely restricted to interest and interest also having different forms, there was enough room to cast doubts on the applicability of terming bank interest as riba.On the one hand the religious prohibition and on the other the seemingly indispensable nature of bank borrowings left the Muslims in a quandary. Absence of a workable alternative system in existence added to the malaise.

The Study:

The subject, Riba in Banking, has been dealt with in various ways. However, we will take a look at it afresh in the light of the verses of Qur’an and reported ahadith of the Prophet (SAWS) that deal with riba. How riba affected the society in the past is well known. Circumstances that led to the prohibition are also taken into account while undertaking this study as a comparative tool in determining its nature in the existing economic scenario.

First, a definition of banking to make things clear as to what it stands for. A bank is a financial institution that accepts deposits from the public and creates credit.[1] The economic viability of banking depends on income. Unlike profits in other business activities, it is interest that acts as its income. They pay interest on deposits received and savings accounts maintained with it. In turn it charges interest on the loans and advances to the borrowers at a higher rate that includes cost of funds, operating expenses and profit.

Before proceeding any further, verses of the Qur’an and ahadithare to be brought before the readers so that the issue can be better understood. Following are the translation of the verses of Qur’an and reported ahadith related to the subject:

“And that which you give in Riba, in order that it may increase from other people’s property, has no increase with Allah; but that which you give in Zakah seeking Allah’s Face, then those they shall have manifold increase.”

(Chapter 30 Ar–Roum.Ayat 39).

Ibn Kathir explains: ‘This means, that which is given as a gift to others in the hope that they will give back more than they were given. There is no reward for this with Allah. This is how this Aayah was interpreted by Ibn Abbas, Mujahid, Ad-Dhahhak, Qatadah, Ikrimah, Muhammad bin Ka’b and Ash-Sha’bi.’

The first revelation regarding riba sets the tone for the wrongful means employed by people to gain wealth. It does not speak about interest or it’s hidden form, the credit-based sales.

The second revelation in this regard came in chapter 4 An–Nisa, verse 161:

“And their taking of riba though they were forbidden from taking it, and their devouring men’s substance wrongfully. And we have prepared for the disbelievers among them a painful torment.”

This verse refers to a community who were also prohibited from taking riba. But most among them indulged in it using devious methods.

The third revelation came in chapter 3 Aal–Imran, verses 130 to 132:

“O you who believe! Do not consume riba doubled and multiplied, but fear Allah that you may be successful.”

“And fear the fire, which is prepared for the disbelievers.”

“And obey Allah and the Messenger that you may obtain mercy.”

The verses from the third revelation refer to usury as riba. The practice that was prevalent during the time of the revelation is referred here, that of charging interest on a loan to the borrower for a specified period, upon expiration of which the borrower was asked to repay or renew the debt doubled or multiplied for a further period. This practice was ruinous to the borrower.

The argument that the present banking system is beneficial to everyone concerned, the lender and borrower alike, and cannot be compared to the system that was prevalent during the period of ignorance (Jahiliyyah) appears to have the basis from this revelation. The oppressive nature of that system is played out as the deciding factor to determine applying the word riba.

The fourth revelation in chapter 2 Al–Baqara is the longest with 7 verses that deals with the subject:

“Those who eat riba will not stand (on the day of resurrection) except like the standing of a person beaten by Shaitaan leading him to insanity. That is because they say:’Trading is only like riba’, whereas Allah has permitted trading and forbidden riba. So whosoever receives an admonition from his Lord and stops eating riba; shall not be punished for the past; his case is for Allah (to judge); but whoever returns (to riba), such are the dwellers of fire – they will abide therein.” (Verse 275)

“Allah will destroy riba and will give increase for sadaqat. And Allah does not like the disbelievers, sinners.” (Verse 276)

“Truly those who believe, and do deeds of righteousness, and perform the Salah and give Zakat, they will have their reward with the Lord. On them shall be no fear, nor shall they grieve.” (Verse 277)

O you who believe! Have Taqwa of Allah and give up what remains from riba, if you are believers.” (Verse 278)

“And if you do not do it, then take a notice of war from Allah and His Messenger but if you repent, you shall have your capital sums. Deal not unjustly, and you shall not be dealt with unjustly.” (Verse 279)

“And if the debtor is having a hard time, then grant him time till it is easy for him to repay; but if you remit it by way of charity, that is better for you if you did but know.” (Verse 280)

And have Taqwa the Day when you shall be brought back to Allah. Then every person shall be paid what he earned, and they shall not be dealt with unjustly.” (Verse 281)

While the above verses are self-explanatory, the warning of notice of war with Allah and His Messenger needs special mention as no other sin, however grave, invites such a declaration.

Ahadith of the Prophet (SAWS) throws more light on the subject as can be seen from the following quotes. They are generally divided into 3 parts. First covers an overview of riba and the second and third parts are called RibaAn–Nasiyah and RibaAl–Fadl. They deal with money matters and trade practices respectively.

Ali and IbnMas’ood narrated that the Messenger (SAWS) said: “May Allah curse whoever consumes riba, whoever pays riba, the two who are witnesses to it and the scribe who records it.”

In reference to the verse 2:276, Al-Bukhari recorded that Abu-Hurayrah said that the Messenger of Allah (SAWS) said: “Whoever gives charity that equals a date from honest resources, and Allah only accepts that which is good and pure, then Allah accepts it with His right (Hand) and raises it for it’s giver, just as one of you raises his animal, until it becomes as big as a mountain.” (FathAl-Bari).

Ibn Abi Hathim recorded that Amr Bin Ahwas said: The Messenger of Allah (SAWS) gave a speech during the Farewell Hajj saying:

“Verily, every case of riba from Jahiliyyah is completely annulled. You will only take back your capital, without increase or decrease. The first riba that I annul is the riba of Al-Abbas bin AbulMuthalib, all of it is annulled.”

From Abdallah Ibn Hanzalah: The Prophet (SAWS) said:

“A dirham of riba that a man receives knowingly is worse than committing adultery thirty six times.”

Al-Bukhari recorded that Samurah bin Jundub said in the long hadith about the dream that the Prophet (SAWS) had:

“We reached a river – the narrator said: “I thought he said that the river was as red as blood” – and found that a man was swimming in the river, and on it’s bank there was another man standing with a large collection of stones next to him. The man in the river would swim, then come to the man who had collected the stones and opened his mouth, and the other man would throw a stone in his mouth.” (Tafsir Ibn Kathir).

From Abu Hurairah: The Prophet (SAWS) said: “On the night of Ascension I came upon people whose stomachs were like houses with snakes visible from the outside. I asked Gabriel who they were. He replied that they were people who had received riba.” (IbnMajah, Kitab Al Tijarat, Bab Al-Taqlizi fi al-riba and Musnad Ahmed).

IbnMajah recorded that Abu-Hurairah said that the Messenger of Allah (SAWS) said: “Riba is seventy types, the least of which is equal to one having sexual intercourse with his mother.”

From Abu-Hurairah: The Prophet (SAWS) said: “There will certainly come a time for mankind when everyone will take riba and if he does not do so, its dust will reach him.” (Abu Dawud, Kitab Al-Buyu, Bab fi ijtinabi al shubuhat; also in IbnMajah).

The above quoted are general in nature. Riba is further divided into two, as said earlier, as follows:

Riba An-Nasiyah:

This category of riba deals with the waiting period involved in making payments on monetary dealings. The increase notwithstanding, waiting period is equally important in all loan transactions without which no loan can be considered as one.

UsamahIbnZayd said: “The Prophet (SAWS) said: “There is no riba except in Nasiyah (waiting). (Bukhari, Muslim and Nasai). It is further clarified as: “There is no riba in hand-to-hand (spot) transactions”. (Muslim and Nasai). The above sum-up Riba An-Nasiyah. Further, it proves that the method of interest calculation, whether simple or compound, is not the factor that determines whether it can be termed riba, as is the case that is made out to be by those who argue quoting the third revelation.

Ahadith that reaffirm the nature of this kind of riba follows: From Anas Bin Malik: The Prophet (SAWS) said: “When one of you grants a loan and the borrower offers him a dish, he should not accept it; and if the borrower offers a ride on an animal, he should not ride, unless the two of them have been previously accustomed to exchanging such favors mutually”. (Sunan Al-Bayhaqi, Kitab al Buyu, Bab Kulli qardin jarra manfa’arlan fa huwa riban).

Anas bin Malik said: The Prophet (SAWS) said: “If a man extends a loan to someone he should not accept a gift”. (Mishkat, on the authority of Bukhara’s Tarikh and IbnTaymiyyah’s Al Muntaqa).

The second category is Riba Al–Fadl:

The Prophet (SAWS) said: “Sell gold in exchange of equivalent of gold, sell silver in exchange of equivalent of silver, sell dates in exchange of equivalent dates, sell salt in exchange of equivalent of salt, sell barley in exchange of equivalent of barley, but if a person transacts in excess, it will be riba. However, sell gold for silver anyway you please on the condition that it is hand-to-hand (spot)”.

From Abu Saeed Al Khudri: The Prophet (SAWS) said: “Do not sell gold except when it is like for like, and do not increase one over the other; do not sell silver except when it is like for like, and do not increase one over the other; and do not sell what is away (from among these) for what is ready.” (Bukhari, Kitab al Buyu, Bab bayl al fiddati bi al-fiddah; also Muslim, Tirmidhi, Nasai and Musnad Ahmed).

From Ubadah ibn al-Samit: The Prophet (SAWS) said: “Gold for gold, silver for silver, wheat for wheat, barley for barley, dates for dates and salt for salt – like for like, equal for equal and hand-to-hand; if the commodities differ, you may sell as you wish, provided that the exchange is hand-to-hand.” (Muslim, Kitab Al-Musaqat, Bab Al Sarfiwabay’l ad-Dhahabi bi al-waraqinaqdan; also in Tirmidhi).

From Abu Saeed Al Khudri: The Prophet (SAWS) said: “Gold for gold, silver for silver, wheat for wheat, barley for barley, dates for dates and salt for salt – like for like and hand-to-hand, whoever pays more or takes more has indulged in riba. The taker and giver are alike (in guilt).” (Muslim and Musnad Ahmad).

From Abu Saeed and Abu Hurairah: “A man employed by the Prophet (SAWS), in Khyber brought for him janibs (dates of very fine quality). Upon the Prophet’s (SAWS) asking him whether all the dates of Khyber were such, the man replied that this was not the case and added that “they exchanged a Sa’ (a measure) of this kind for two or three (of the other kind).” The Prophet (SAWS) replied: “Do not do so. Sell (the lower quality of dates) for dirhams and then use the dirhams to buy janibs. [When dates are exchanged against dates] they should be equal in weight.” (Bukhari, Kitab Al Buyu, Bab Idha arada bay’a tamrin Khairun minhu; also Muslim and Nasai).

From Abu Saeed: Bilal brought to the Prophet (SAWS), some barni (good quality) dates whereupon the Prophet (SAWS) asked him where these were from. Bilal replied, “I had some inferior dates which I exchanged for these – two Sa’s for a Sa’.” The Prophet said: “Oh no, this is exactly riba. Do not do so, but when you wish to buy, sell the inferior dates against something [cash] and then buy the better dates with the price you receive.” (Kitab Al Musaqat, Bab al-ta’ami mithlan ba mithlin; also Musnad Ahmad).

From Fadalah Ibn Ubaydah al Ansari: On the day of Khyber he bought a necklace of gold and pearls for twelve dinars. On separating the two, he found that the gold itself was equal to more than twelve dinars. So he mentioned this to the Prophet (SAWS) who replied: “It (jewellery) must not be sold until the contents have been valued separately.” (Muslim, Kitab al Musaqat, Bab bayl al qiladah fiha khara-zun wa dhahab; also in Tirmidhi and Nasai).

From Abu Umamah: The Prophet (SAWS) said: “Whoever makes a recommendation for his brother and accepts a gift offered by him has entered riba through one of its large gates.” (Bulugh Al Maram, Kitab Al Buyu, Bab al riba, Reported on the authority of SunanAl–Bayhaqi).

From Abdalla Ibn Abi Awfa: The Prophet (SAWS) said: “A Najish [one who serves as an agent to bid up the price in an auction] is a cursed taker of riba.” (Fath Al Bari, Kitab Al Buyu, Bab Al Najsh; also in Suyuti, Al Jami Al Saghir, under the word al-najsh and Kanz al-Ummal – op. cit., both on the authority of Tabarani’s Al-Kabir).

From Anas Ibn Malik: The Prophet (SAWS) said: “Deceiving a mustarsal [an unknowing entrant into the market] is riba.” (Suyuti, al-Jami al Saghir, under the word Ghabn; Kanz Al-Ummal, Kitab Al Buyu, Al-Bab al-thani, al-fasl al-thani, on the authority of Sunan al-Bayhaqi).

Some points to ponder over from the above quotes:

1. As has been quoted above, the verses 130 of chapter 3, Aal-Imran and part of the verse 279, chapter 2, Al Baqara form the nucleus of the term riba. The sentence,“Deal not unjustly, and you will not be dealt with unjustly” gains prominence when categorizing a deal or a practice as riba.

2. While explaining ribaAn–Nasiyah, reference is not made to its usurious nature, but states: “There is no riba except in Nasiyah (waiting)”; further clarified as: “There is no riba in hand– to – hand ”, meant to be spot transaction. This hadith undoubtedly establishes that ‘waiting’ or the loan period is crucial to call the transaction as involvingriba irrespective of its nature as usurious or not. It is a significant departure from the assumption that only usury can be termed riba. Further, limiting the scope of riba as binding only to usury would in effect negate this prophetic saying. The body of ahadith that deal with Nasiyah unequivocally establishes the fundamentals of riba as waiting and increase. Excluding the non-usurious forms of lending from the purview of riba thus does not stand validation.

3. The hadith that prohibits those who lend, not to take any favor from the borrower, further strengthens the view that usury does not figure in the loan transactions to be classified as riba.

4. Riba al-Fadl, though deals with the archaic system of barter in trading,reaffirms that riba is in waiting and increase. While goods replace money, as trading is the subject that is dealt with, the components are the same here too: waiting and increase. Trade credit that is widely practiced today has similar elements. While cash credit forms first line of lending, second line of lending takes place when goods are sold on deferred payment basis. It carries interest component added to the selling price. However, some clarification is forthcoming when the subject discussed is credit-based trade. Some scholars have been of the opinion that credit trade is permissible when parties involved, the buyer and the seller, are satisfied with the transaction even though an increase in selling price is present; with a rider that the buyer cannot sell the goods bought before the payment for it is made; virtually closing the door on traders who buy goods on credit to sell it to the end-user as is the practice today. By following this ruling, the possibility of selling goods to the consumer on credit is limited to deals where the buyer is in need and does not have enough funds to pay for it resulting in his agreement to an increase.

Contradictions:

Though there is unanimous agreement among the scholars of Islam that interest is riba where lending of money is concerned, there have been opinion contrary to it coming mainly from those who hold a view that only the usurious system of lending can be termed so. Though miniscule in number, those who differ are supported by a large group of Muslims who have interests in industry and trade and have credit relations with banks. Their numbers are on the rise, as banking has become a part of people’s daily life.

Among them there are those who do not bother about the issue and go on indulging in what suits their business interests or the ones whose livelihood depend on the employment in such institutions. Also are some who seek a favorable edict to satisfy their conscience. The numbers of those who argue on the seemingly beneficial nature of banking to justify their involvement is not small too. And, there are the ones who wish to be seen on the side that is right. Though they tend to look deeper, ultimately they would end up backing the argument that favors bank interest, based on the verses of the Qur’an alone, to establish the point of view that usurious lending only is the differentiating factor to determine whether a financial transaction is riba or not.

As the lending system that prevailed at the time of revelation of the verses was based on usury, it is undeniable that the forbiddance was meant to end that practice. Verse 130 of chapter 3, Aal–Imran and a part of verse 279 of chapter 2, Baqara form the nucleus of riba. While there is no dispute over the nature of these verses terming riba as an unjust practice, the stand that interest based banking practices cannot be called so is the bone of contention.

In spite of holding similar views as to the verses of Qur’an, disparity appears when it comes to application of the termriba, whether it can be applied across the board or in selective forms of interest. It primarily appears from the neglect of ahadith.

Another reason put forward to make it appear that riba is not properly explained is quoting the statement that Umar bin Khattab (RA) made:

“I wished that the Messenger of Allah (SAWS) had made three matters clearer for us, so that we could refer to his decision: the grandfather (regarding inheriting from his grandchildren), the Kalabah (those who leave neither descendants nor ascendants as heirs) and some types of riba.” (Fath al Bari 10:48, Muslim 4:2322). (TafsirIbnKathir).

However, the matter does not end there. The following are to be read together with the above statement to make things clear.

In continuation of the statement of Umar (RA), IbnKathir states that:

‘The Sunan records that Al Hasan bin Ali said that he heard the Messenger of Allah (SAWS) say:

“Leave that which makes you doubt for that which does not make you doubt”. (Tuhfat ul Ahwadi 7:221, An–Nasai 8:328).

The two sahihs recorded that An-Numan bin Bashir said that he heard the Messenger of Allah (SAWS) say:

“Both lawful and unlawful things are evident, but in between there are matters that are not clear. So, whoever saves himself from these matters, he saves his religion and his honor. And whoever indulges in these unclear matters, he will have fallen into prohibitions, just like a shepherd who grazes (his animals) near a private pasture, at any moment he is liable to enter it.”

Ahmed recorded that Said bin Al Musayyib said that Umar said:

“The Aayah about riba was one of the last Aayaat to be revealed, and the Messenger of Allah (SAWS) died before he explained it to us. So leave that which makes you doubt for that which does not make you doubt.” (Ahmed 1:36, Ibn-Majah 8:328)’. (TafsirIbnKathir).

Importance of Ahadith:

Failure to understand its importance has led many to interpret verses of the Qur’an the way they thought right. Allah (SWT) says in the Qur’an:

“Had not the grace of Allah and His Mercy been upon you, a party of them would certainly have made a decision to mislead you, but they misled none except their own selves, and no harm can they do to you in the least. Allah Has sent down to you the Book, and the Hikmah, and taught you that which you knew not. And ever great is the grace of Allah unto you.” (Chapter 4, An-Nisa’, verse 113).

“And whoever contradicts and opposes the Messenger after the right path has been shown clearly to him, and follows other than the believers’ way, We shall keep him in the path he has chosen, and burn him in Hell – what an evil destination.” (Chapter 4, An-Nisa. Verse 115).

Nothing more needs to be said or explained to emphasize the importance of Ahadith as that is what is meant by the word ‘Hikmah’. It means ‘wisdom and understanding about the divine’. (Wiktionary).(Not to be confused with the Urdu word Hikmat meaning ‘Cunning’)(urdupoint.com). Ignoring them to prove a point with only the meaning of verses could lead to misinterpretation. Thus, taking into account the explanations in the ahadith, the categorization of riba cannot solely be based on usurious lending.

The Injustice:

Getting into the finer aspect of riba, let us examine the injustice part that has been emphasized in the end of verse 279 of Sura 2, Al-Baqara. Dhulm, the Arabic word means injustice, Oppression and Wrongdoing. The translation of the verse reads:

“And if you do not do it, then take a notice of war from Allah and His Messenger but if you repent, you shall have your capital sums. Deal not unjustly, and you shall not be dealt with unjustly.”

The notice of war from Allah (SWT) and His Messenger (SAWS) proclaimed is no mean challenge. While its gravity does not need elaboration, it must be noted that no other sin invites such proclamation.A wrong doing that causes a notice of war and termed as injustice. To know its importance, we must look at the word Dhulm. It is the opposite of the Arabic word Adl(justice). It is reported to be an Attribute(Sifaat) of Allah (SWT). Translation of the verses revealed based on Adl are quoted below:

a) “O you who believe! When you contract a debt for a fixed period, write it down. Let a scribe write it down in justice between you…….” (Sura 2 Al Baqara, verse 282).

b) Surely, Allah wrongs not even of the weight of a speck of dust, but if there is any good (done), He doubles it, and gives from Him a great reward. (An-Nsia 4:40).

c) Verily, Allah commands that you should render back the trusts to those, to whom they are due; and that when you judge between men, you judge with justice. Verily, how excellent is the teaching which He (Allah) gives you! Truly, Allah is Ever All Hearer, All Seer.” (An-Nisa 4:58).

d) “O you who believe! Stand out firmly for justice, as witnesses to Allah, even though it be against yourselves, or your parents, or your kin, be he rich or poor, Allah is a better Protector to both. So follow not the lusts, lest you may avoid justice; and if you Talwu or Tu’ridu, it, verily, Allah is well-Acquainted with what you do.” (An-Nisa 4:135) and if you Talwu or Tu’ridu – means “Distort your testimony and change it”, according to Mujahid and several others among the Salaf. Talwu includes distortion and intentional lying. (At-Tabari 9:308).

e) “O you who believe! Stand out firmly for Allah as just witness; and let not enmity and hatred of others make you avoid justice. Be just, that is nearer to Taqwa; and have Taqwa of Allah. Verily, Allah is well acquainted with what you do.” (Al Maidah 5:8).

f) “And the word of your Lord has been fulfilled in truth and in justice. None can change His Words. And He is the All-Hearer and All-Knower. (Al Anaam 6:115).

g) Say: “My Lord has commanded justice and that you should face Him only, in every Masjid and invoke Him only, making your religion sincere to Him. As He brought you (into being) in the beginning, so shall you be brought into being again.” (Al-Aaraf 7:29).

h) Verily Allah orders justice and kindness, and giving (help) to the relatives, and He forbids immoral sins, and evil and tyranny. He admonishes you, so that perhaps you may take heed.” (An-Nahl 16:90).

i) “And We shall set up balances of justice on the Day of Resurrection, then none will be dealt with unjustly in anything. And if there be the weight of a mustard seed, We will bring it. And sufficient are We to take account. (Al-Anbiya 21:47).

j) “Give full measure, and cause no loss (to others).” “And weigh with the true and straight balance.” “And defraud not people by reducing their things, nor do evil, making corruption and mischief in the land.” ”And have Taqwa of Him Who created you and the generations of men of old.” (Ash-Shura 26:181-184).

k) “And come not near the Orphan’s property, except to improve it, until he (or she) attains the age of full strength; and give full measure and full weight with justice.” – We burden not any person, but that which he can bear – “And whenever you speak, say the truth even if a near relative is concerned, and fulfill the Covenant of Allah. This He commands you, that you may remember,” (Al-An’am, 6:152).

l) “So unto this you invite (people), and stand firm as you are commanded, and follow not their desires but say: “I believe in whatsoever Allah Has sent down of the book and I am commanded to do justice among you. Allah is our Lord and your Lord. For us our deeds and for you your deeds. There is no dispute between us and you. Allah will assemble us (all), and to Him is the final return. (Ash-Shura 42:15).

m) “Indeed we have sent our Messengers with clear proofs, and revealed with them the Scripture and the Mizan that mankind may keep up justice. And We brought forth iron wherein is mighty power, as well as many benefits for mankind, that Allah may test who it is that will help Him (His religion) and His Messengers in the unseen. Verily Allah is Powerful, Almighty. (Al Hadid 57:25).

On Dhulm, some from Ahadith:

From Hadith Qudsi: “O My slaves, I have forbidden oppression to Myself, and I have made it unlawful among you, so do not wrong one another.” (Muslim: 2577).

The Prophet said: “Beware of oppression, for oppression will be darkness on the Day of Resurrection.” (Muslim: 2578).

The Prophet said: “Whoever swears an oath in order to unlawfully take the right of another Muslim, Allah will decree the fire for him and forbid paradise to him.” A man said: “Even if it is something insignificant O Messenger of Allah?” He said: “Even if it is a twig from an Arak tree.” (Muslim: 137).

In a hadith reported by Al Bukhari (3150) and Muslim (1062) from Abd Allah Ibn Mas’ud: (when a man objected to the manner in which war booty was divided) the Prophet (SAWS) said: “Who will be just if Allah and His Messenger are not just?”

Dhulm stands in contrast to justice. Above verses prove beyond doubt the importance of justice in the practice of Islam. The punishment for doing injustice also is made clear in the verses that pertain to riba. Now comes the applicability of Dhulm in banking. Unless otherwise proved as an act of injustice, it cannot be applied on other forms of interest. Like in the case of usurious interest, it must prove to be an act of injustice. We will follow the example of the state of affairs that existed during the time of the revelations that proved to be the practice of injustice and was termed riba. Today, it is the banking practices related to lending and its effects that has to be put to test and see whether it qualifies for the tag of riba.

Dhulm in Banking:

This section is solely aimed at providing material to determine whether bank interest can also be termed riba. Here, the measure of injustice is based on banking and related economic practices. While lending practices during the period of revelations that resulted in prohibition of usurious interest is accepted, interest that is common in all loan transactions continues to be the bone of contention. Unlike the borrower being unjustly dealt with in usurious loans, it is pointed out that the borrower is a beneficiary here. No doubt, in most cases they are. It has to be reiterated that it cannot be considered the sole criterion that invitesprohibition. It would be deemed unjustin anysociety apractice that proves to cause hardship to a sectionof the population irrespective of whether it is beneficial to a few.

Before we start the analysis, the basics of banking are to be explained to those who are not familiar with the way the system works. The main component of the banking system being money, its role is to be understood first.

Money:

The primary function of money is that of a medium of exchange, the others being a unit of account, a store of value and a standard of deferred payment.[2] However, its history has been that of a commodity value as well when it used to be in the form of coins in precious metals. Gold and silver used to be the preferred metals and carried the value equivalent to its weight. That is history for posterity. Today we have fiat money. Unlike precious metals, it has no intrinsic value that can be converted into an asset. Its acceptability comes from the order by the government of the country to pay the equivalent amount on demand. In effect the holder of the currency will get a replacement of an equivalent amount of the same currency upon claim.

Money issuing authority, among other functions, lies with the central bank of the country established by the government. Creation of money takes place in two ways, in the form of legal tender or narrow money and Bank money or broad money. The former created by a Central Bank by minting coins and printing banknotes and the latter created by commercial banks by making loans to borrowers.[3].

Central banks issue money from time to time when the government is in need to fund infrastructure development, etc. against purchase of government bonds. New money is introduced into the economy by central bank against purchase of financial assets or lending it to commercial banks. In turn they offer it to credit worthy borrowers. The issue of new money takes place to overcome deflationary trends in the economy where money crunch leads to down turn in demand for goods and services. Fiat money, born by virtue of debt is a product of credit. From the central bank down to the trading community, its creation is more out of need to create debt than as a financial asset as commonly viewed.[4].

Commercial Banks:

We will now study the workings of commercial banks. As we all know, their function is mainly to receive deposits, holding money belonging to account holders and lend these funds to borrowers. In majority of cases money held by banks is liable for payment of interest to the depositors. In turn the money lent is charged interest. Other functions of the banks are of service oriented in nature and does not bring in any sizable return as the interest on money lent does. Thus the banks’ role as a facilitator to the depositors and borrowers put them in a position of enormous economic power. Now, let’s take a closer look at the way the system works.

The amount of money available in the market determines the value of goods and services it holds. If the value of currency in circulation in an economy is USD 10 billion, the value of all the assets will be considered as worth that much. When fresh supply of USD 1 billion is added to it, the amount in circulation goes up and the total value of assets of that economy becomes USD 11 billion. Thus monitory inflation takes place in that economy.

The increased value of goods and services should become affordable, if not for all, at least to the majority of the population. Since the increase in income does not percolate down to the low middle and lower strata of the population, affordability becomes limited to those who have the means.

When purchasing power of the currency drops, goods and services become dearer. Increase in cost of living leads to demand for higher wages. Once it is met, the increased wages add to input cost leading to further increase in prices. Like chasing the mirage in a desert, it becomes an exercise in futility for those who do not have the opportunity to enhance their income level. Situation gets exacerbated in economies with high unemployment levels and creeping up poverty index.

As already said, commercial banks function under the guidelines set by the central bank. One of it is that they cannot lend all the deposits received, but maintain a certain percentage as reserve so that normal withdrawal demand by the account holders can be met. In some countries the banks need not maintain reserve ratio. Central banks of these countries have alternative systems to control lending by commercial banks. Most countries maintain the reserve ratio. While in some countries it is between 10 to 15% of the deposits, there are also countries that maintain 3% reserve ratio. This banking system is known as Fractional Reserve Banking (FRB).

The system works like this: if the required reserve ratio is 0.10, the bank is obliged to keep 10% of the money lent with the central bank or maintain it as reserve, depending on the central bank policy. For example, an amount of USD 100,000 received as deposit, the bank can lend up to USD 90,000, holding USD 10,000 as reserve requirement. The borrower pays that 90,000 to someone who in turn deposits it in his account with another bank. His bank lends 81,000 to someone else after deducting the reverse requirement of 9,000 (10%). That borrower of 81,000 pays it to his creditor and that sum gets deposited in the account of yet another bank and an amount of 72,000 is given as loan by that bank after deducting 10%. The cycle of lending continues until the cumulative reserves become USD 100,000. However, the total amount lent by all these banks (originated as a loan of USD 90,000) would have multiplied approximately ten times. Thus the money in circulation in the market would be somewhere in the region of USD 1 million. This is known as money multiplier.

We have seen the central bank creating money for the government as well as to keep circulation of money in the economy. Here we see another form of money creation by commercial banks. Against a 100,000 deposit, the banks have created about 900,000 in new money. While the original 100,000 stays with the central bank as RRR, the new money is created out of thin air.

This tenfold increase in money circulation causes further monetary inflation. Every time a deposit is made into a bank account, 90% of it reaches the market as loans fuelling money supply and resultant inflation. While banks make huge profits from this type of money creation, the hardship people of the lower strata of the society face due to inflation is unmitigated.

As stated earlier, the effect of monetary inflation is reflected in lower purchasing power of the currency. To the man on the street, it is increase in cost of living. Not familiar with economics he would blame the grocer. Over the years what was available for USD1 then has been costing more and would now be USD10. It is not a new phenomenon. We all have been experiencing it time and again. To the salaried and wage earners, either the savings have been shrinking for some or for the rest meeting needs become difficult. No relief in sight, most of the affected are left with neither means nor opportunities to overcome the crisis.

There are other forms of inflation too that takes place through causes other than excess money supply, like scarcity of goods, natural calamities, war, etc. They are not perpetual by nature and brought under control once the cause is arrested or it tides over. On the other hand, effect of monetary inflation on the economy lingers on. Increase in money supply that causes inflation is not limited to the issuance of new currency alone, the money multiplier also figures that adds to further inflation.

Though there are controlling mechanisms available with central banks, the money multiplier system appears to be on an ascent as is visible in the escalation of cost of living.

There is an alternative system of banking, that is 100% reserve banking. Under this system, deposits are to be maintained by the banks. The possibility of a ‘bank-run’ is absent. But interest is not payable on deposits. However, this alternative does not find favor with most of the banking community.

Accumulation of wealth into fewer hands:

A fall-out of money multiplier is the accrual of wealth into fewer hands. Creation of money by banks through the money multiplier system encourages investments in industries and business. Banks being the main source of funding for industrial and trading community to establish or expand their activities, those who have access to funds are the business community whose members form the smallest percentage of the population in any country. Credit worthiness being the criterion for eligibility to borrow, the wealthy are the ones who get major chunk of bank finance. Among the rest of the population a section of them are able to find employment and it becomes the source for sustenance and savings. Rest of the population find sustenance in the unorganized sector and farming in countries where population is high and educational levels are low. Unemployment forms a sizable portion.

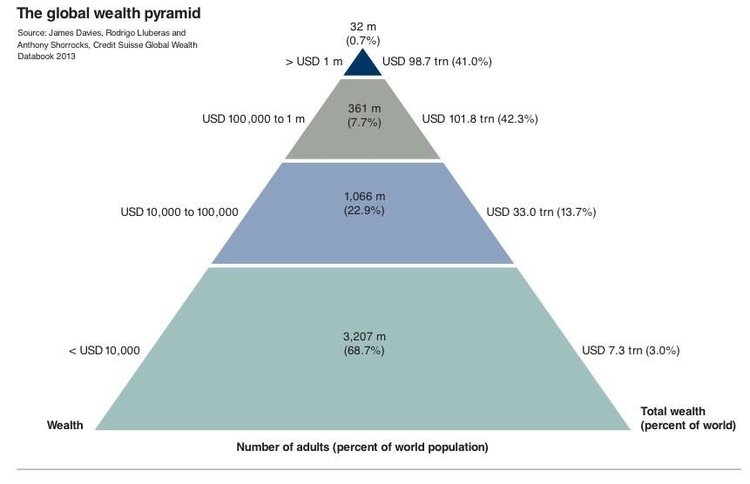

Before going into the details of the subject, let us take a look at a study conducted by Credit Suisse in 2013. It estimates globalwealth distribution calculated in net worth (assets minus liabilities). It shows that:

– Nearly half of world’s wealth belongs to top 1%.

– Top 10% adults hold 85% while bottom 90% has only 15% of total wealth.

– Top 30% adults hold 97% of wealth.

The estimate:

Income Population Wealth

*Number of adults (percent of world population). [5]

These figures are based on world population that includes G8, western industrialized nations and the oil rich economies whose population enjoy higher income compared to third world countries. If figures for the third world countries alone were to be taken, it will show an abysmal picture.

How does this flow of wealth into fewer hands happen? If 100% investments come from the owners/shareholders of the industries and businesses, necessity to study the outcome does not arise. If not, there must be a catalyst that makes it possible. Of course, profits play a part. Simple and natural as it may appear, how did these profitsitself get accumulated into fewer hands when the investment did not come totally from them? Here, we see the banks playing the role of the facilitator. Major chunk of finance comes from banks. They are instrumental in profits going into fewer hands. More on this will be discussed later. This is one part of the act. The chasm between the wealthy and the members of the lower rung of the society is brought about by some more factors that the banks have played a part in.

We have seen that central banks introduce new money into the market through commercial banks. Add money multiplier, and banks have much more in hand to lend. Naturally, banks take the lending route to pump money into the market. Since money cannot be distributed equally among the population, those who borrow from banks get more to invest in businesses or acquiring assets. This first line of beneficiaries get new money at a time when prices of goods and services are lower as inflation has not set in. It helps them in comparatively cheaper investment opportunities. By the time the new money reaches the mid and low income groups in the form of salaries and wages, prices have gone beyond their meager savings.They are unable to invest in assets they had waited for.[6][7]

The advantage over others in acquisition of assetsthat the first and second line borrowers have starts with the process of bank lending.Being early birds they get the best of opportunities having sufficient means and comparative advantage in terms of lower costs. The salaried classin comparison are disadvantaged by time lag, insufficient funds, cost escalation, etc. leaving them far behind the wealthy. The head start that the first-line borrowers have over others results in greater accumulation of wealth that widens the dividefurther.

Dearth in avenues of investment leaves the middle and low-income groups holding their savings in cash that does not generate any returns. Loss in value of money held is comparatively more as other forms of assets gain some value due to inflation. This situation drives them to risky investments or parking their money in banks that generate income. Though meager, it some what compensates the loss due to depreciating value of money. By default or design, it helps banks to have increased deposit base.

Accumulation of wealth in fewer hands and the role banks play in facilitating it having been explained, the means that culminates in it needs to be looked into. Since funds employed are not totally from own sources, banks are the only other source that fills the funding needs. Since banks finance the funding needs, there emerge two aspects that lead to deprivation: cost of funds and lack of opportunity to participate in investments.

Cost of funds & Investment opportunity:

To the bank, interest charged on loans and advances consist of cost of funds (interest paid on deposits), operating expenses and profit. The borrower employs the funds in manufacturing/trading activities adding the bank interest as a part of costing.

In this exercise, one aspect that demands attention is the cost of funds. Though not in size, its role is crucial to the function of manufacturing and trading process. Money being the lifeline of any industry or trade, its source is limited to the paid-up capital in the form of shares held by the public or private holdings and loans that are mostly provided by banks. While capital, in reality is free of cost, bank loans carry interest that is cost of funds.

The structure of funding to the bank is the interest paid on deposits (say 5%) and to the borrower it is the percentage of interest charged by the bank (say10%) that includes cost, expenses and profit. The borrower, that is the manufacturerpasses the entire burden to the consumer. While only a small percentage of consumers are involved in the process of banking by being depositors, most are not in any way related to this system. They are left to bear the entire funding cost. Assuming the consumption to be equal to what was produced in the economy, on an average the consumer who is also the depositor of funds in the bank stands to lose 5% after deducting the interest received on his deposits. The segment that has no deposit accounts with banks is the one that hasto bear the entire interest costof 10%. This is only a part of the process, that is, between the manufacturer and the consumer. In reality the manufacturer in most cases does not sell directly to the consumer. There are other entities, from distributors to wholesale and retail traders who, if they use borrowed funds, add their cost of funds and profits. All these add up to the retail price of a product.

To those who save, opportunity to invest in these enterprises is lost when banks offer credit that would entail all the profits accruing to the business community. Here greed overtakes guilt. Spirit of sharing is the casualty.

What would have been an opportunity to initiate equitable distribution of wealth is lost. Unable to participate directly in the economy, the money savers remain mere employees. Though there are examples of employee participation in equity, they are few and far between to be of any significance.

It may sound ridiculous to question the laid down practice of considering interest paid as part of cost of production. However, it raises certain ethical questions. Whateveris in practice need not be just. Not denying the fact that the system has been in existence since long and cost of funding has also been a part of product cost, it cannot be passed off as a just practice. While claims are being made that interest is not charged on consumption but on production only, unlike the practice of charging usurious interest was the norm for even borrowings on consumption purposes in the past, in effect even today interest is charged to the consumer in the form of added cost for the consumables too. Modern economics may not make any bones about it.Since it is notconsidered an issue, the question of ethics remains buried.

It must be borne in mind that, in reality cost of funds does not form a part of the production process. It is not an ingredient that goes into making a product. It is not an indispensable factor of production. Unlike labor and raw material, which areirreplaceable, credit has alternative, that too where the cost of funds does not figure.

Conclusion:

Thus the adverse effects of bank lendingon the mid/low income groups can be summed up as:

– Monitory inflation mainly due to money multiplier.

– The lending system that is instrumental in depriving theses groups to become equitable partners in the economy.

– Interest becoming a cost factor burdening these groups while they are the main contributors to bank deposits.

– Instrumental in accumulation of wealth in fewer hands.

While the victims of usurious lending system can be considered guilty for their ruin having got into it knowingly, most of today’s sufferers are not even aware of the catastrophe that befalls them. In the former case it was only the person that got involved had suffered, whereas here the affected are numerous. Can this practice be termed just, especially where there are alternative avenues to fulfill the funding needs?

In the case of lenders of the past and the present, their motive has remained same, increase in their income that is interest. When lenders used to charge interest in multiples during the time of revelation, today banks use money multiplier that brings in interest tenfold. If interest charged in multiples in the past can be termed unjust and prohibited, can’t today’s bank lending system be viewed the same way?

Sadly the issue gets dragged-on with opinions bandied about creating an atmosphere of uncertainty. In the prevailing situation, commendable is the stand taken by scholars of Islam in their view that all forms of financial dealings that carries interest isriba. They have resisted the efforts of powers that be to reconsider their stand on bank lending. Except for a few who succumbed to the pressures, it has largely been rebuked.

However, when it comes to the masses, the present scenario paints a different picture. As explained earlier, they are increasingly getting involved with the banking system. In the case of Muslims who are involved in bank credits and deposits, merely holding them guilty would not solve the issue. Although there are alternative systems in existence, none appear to have grabbed their attention. If vastly changed economic conditions that necessitate higher funding needs is attributed as a reason, then the solution must also be tailored to address the issue. Where banking has filled the void, the alternative system should also be capable of the same but built on the principle of justice for all. Looking at it from the banking perspective, what is on offer today as an alternative appears to raise more questions than answers. It belies the weakness compared to the strength the present banking system has built up. In the recorded history, no other system has enjoyed so much trust as the banks have. From international financial institutions to the local bank branch around the corner of the street, their influence in the financial matters of people is unmatched. It cannot be replaced easily.

It is not that the situation is bereft of solutions. The Prophet of Allah (SAWS) has not left us without solutions. It is for us to make it work that suits the present climate. Purity of faith is paramount in every endeavor. We do not have to look far into the history to see how it has come about. Allah (SWT) gave enormous wealth to the people of the Arabian Gulf countries virtually beneath their feet. All we have to do is to work towards it. Like everything else, success also comes from Allah (SWT).

************************************************************************************************************************************************

Quranic quotes and related ahadith are quoted from TAFSIR IBN KATHIR (ABRIDGED) Second Edition: July 2003 published by Maktaba Dar-us-Salam.

Most of the ahadith on riba are quoted from RIBA IN HADITH www.ibrahimm.com

References:

[1] Wikipedia – Banks – Definition.

[2] Wikipedia – Money.

[3] Wikipedia – Money.

[4] Wikipedia – Money Creation.

[5] Wikipedia – Distribution of Wealth.

[6] How monetary inflation increases inequality – Philip Bagus – 6 June 2014 – Institute of Economic Affairs – Blog – Policies – Monetary Policy.

[7] Wikipedia – Credit.

—————————————————————————————————————————————————————————————–